Factors that can help determine your mortgage rate

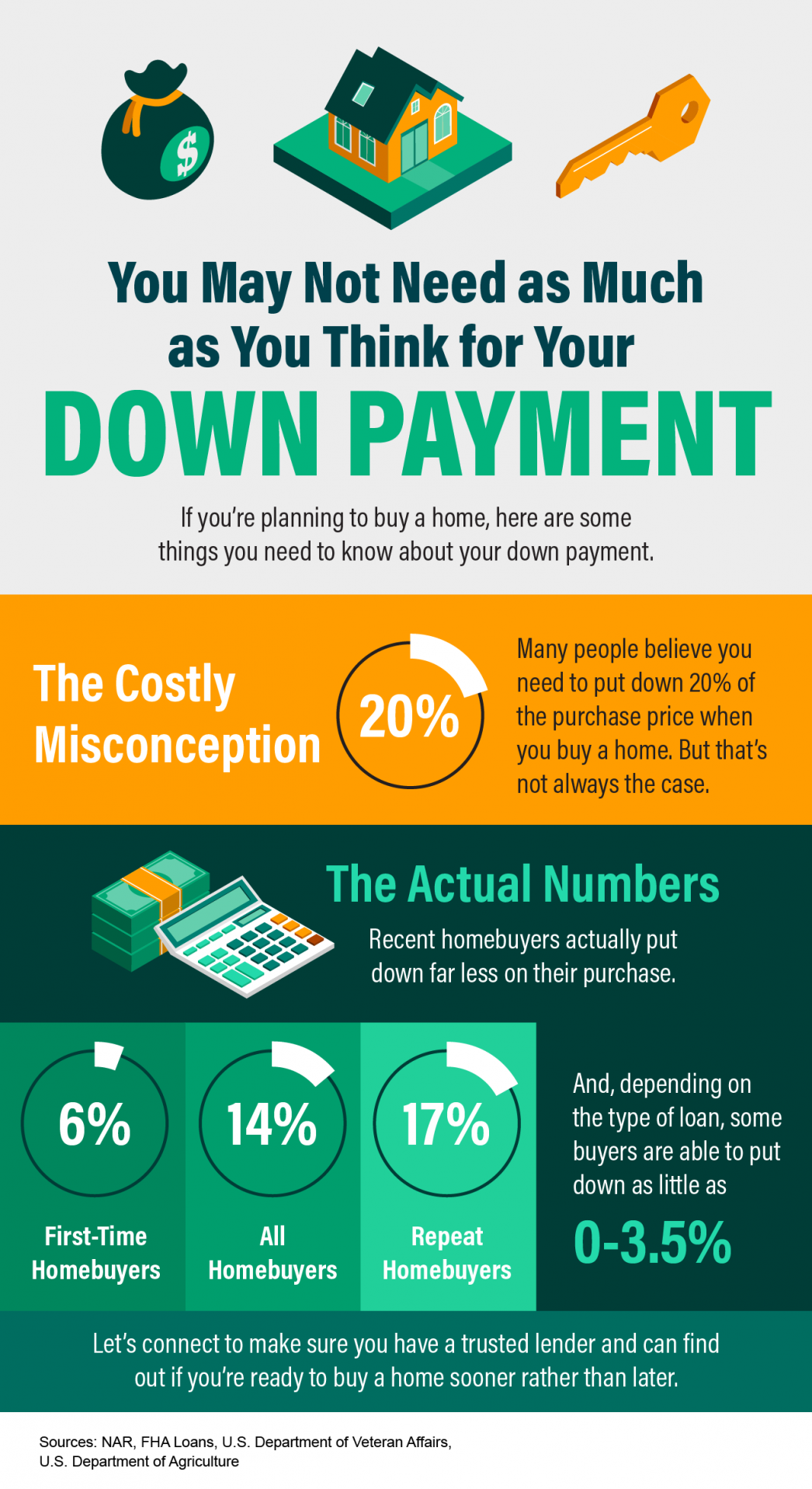

Four Things That Help Determine Your Mortgage Rate If you’re looking to buy a home, you probably want to secure the lowest interest rate possible for your home loan. Over the last couple of years, that was easier to do as the housing market saw record-low mortgage rates, but this year rates have risen dramatically. If you’re looking for ways to combat today’s higher rates and lock in the lowest one you can, here are a few factors to focus on. Since approval opportunities can vary, connect with a trusted lender for customized advice. Your Credit Score Credit scores can play a big role in your mortgage rate. Freddie Mac explains: “When you build and maintain strong credit, mortgage lenders have greater confidence when qualifying you for a mortgage because they see that you’ve paid back your loans as agreed and used your credit wisely. Strong credit also means your lender is more apt to approve you for a mortgage that has more favorable terms and a lower interest rate.” That’s why it’s important to maintain a good credit score. If you want to focus on improving your score, your trusted advisor can give you expert advice to help. Your Loan Type There are many types of loans, each offering different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says: “There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose.” When working with your real estate advisor, make sure you find out what’s available in your area and which types of loans you may qualify for. Your Loan Term Another factor to consider is the term of your loan. Just like with location and loan types, you have options. Freddie Mac says: “When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.” Depending on your situation, the length of your loan can also change your mortgage rate. Your Down Payment If you’re a current homeowner looking to sell and make a move, you can use the home equity you’ve built over time toward the down payment on your next home. The CFPB explains: “In general, a larger down payment means a lower interest rate, because lenders see a lower level of risk when you have more stake in the property. So if you can comfortably put 20 percent or more down, do it—you’ll usually get a lower interest rate.” To learn more, connect with a lender to find out the difference a higher down payment can make for your new mortgage. Bottom Line These are just few factors that can help determine your mortgage rate if you’re buying a home. The best thing you can do is have a team of professionals on your side. Connect with a local real estate professional and a trusted lender so you have the expert advice you need in each step of the process.

Read More

Top 5 Curb Appeal Action Items

First impressions really do matter when it comes to selling a property. That's why taking action to boost your home's curb appeal is so important. In fact, many buyers make up their minds about a home before they even step inside. So, what can you do to make sure your home leaves a great first impression? Here are our top 5 curb appeal action items: 1. A fresh coat of paint: One of the easiest and most effective ways to boost your home's curb appeal is with a fresh coat of paint. Whether you're repainting the entire exterior or just touching up some trim and shutters, a clean, vibrant coat of paint can work wonders. 2. Landscaping: Landscaping can make a huge difference in the appearance of your home. Make sure your lawn is mowed, edged, and free of weeds. If you have mulch beds add fresh mulch. Plant some colorful flowers or add some bushes or trees to enhance the overall look of your yard. 3. Upgrade the front door: Your front door is one of the first things visitors see when they arrive at your home. Consider giving it a fresh coat of paint or replacing it altogether with a new, more stylish door. This can be a relatively low-cost way to really make your home stand out. 4. Add outdoor lighting: Outdoor lighting not only looks great, but it also adds an extra layer of security to your home. Consider adding some spotlights to highlight your landscaping or some path lights to guide visitors. 5. Clean your windows: It may seem like a small thing, but clean windows can really make a difference in how your home is perceived. Make sure all of your windows are clean and spot-free, both inside and out. By following these simple steps, you can greatly improve your home's curb appeal and make it more attractive to potential buyers. Remember, you never get a second chance to make a first impression, so take the time to make your home look its best.

Read More