building Equity with Home ownership

How Owning a Home Builds Your Net Worth Owning a home is a major financial milestone and an achievement to take pride in. One major reason: the equity you build as a homeowner gives your net worth a big boost. And with high inflation right now, the link between owning your home and building your

Read More

Buy or Rent?

Should I Rent or Should I Buy? [INFOGRAPHIC] Some Highlights It’s worth considering the many benefits of homeownership before you make the decision to rent or buy a home. When you buy, you can stabilize your housing costs, own a tangible asset, and grow your net worth as you gain equity. When yo

Read More

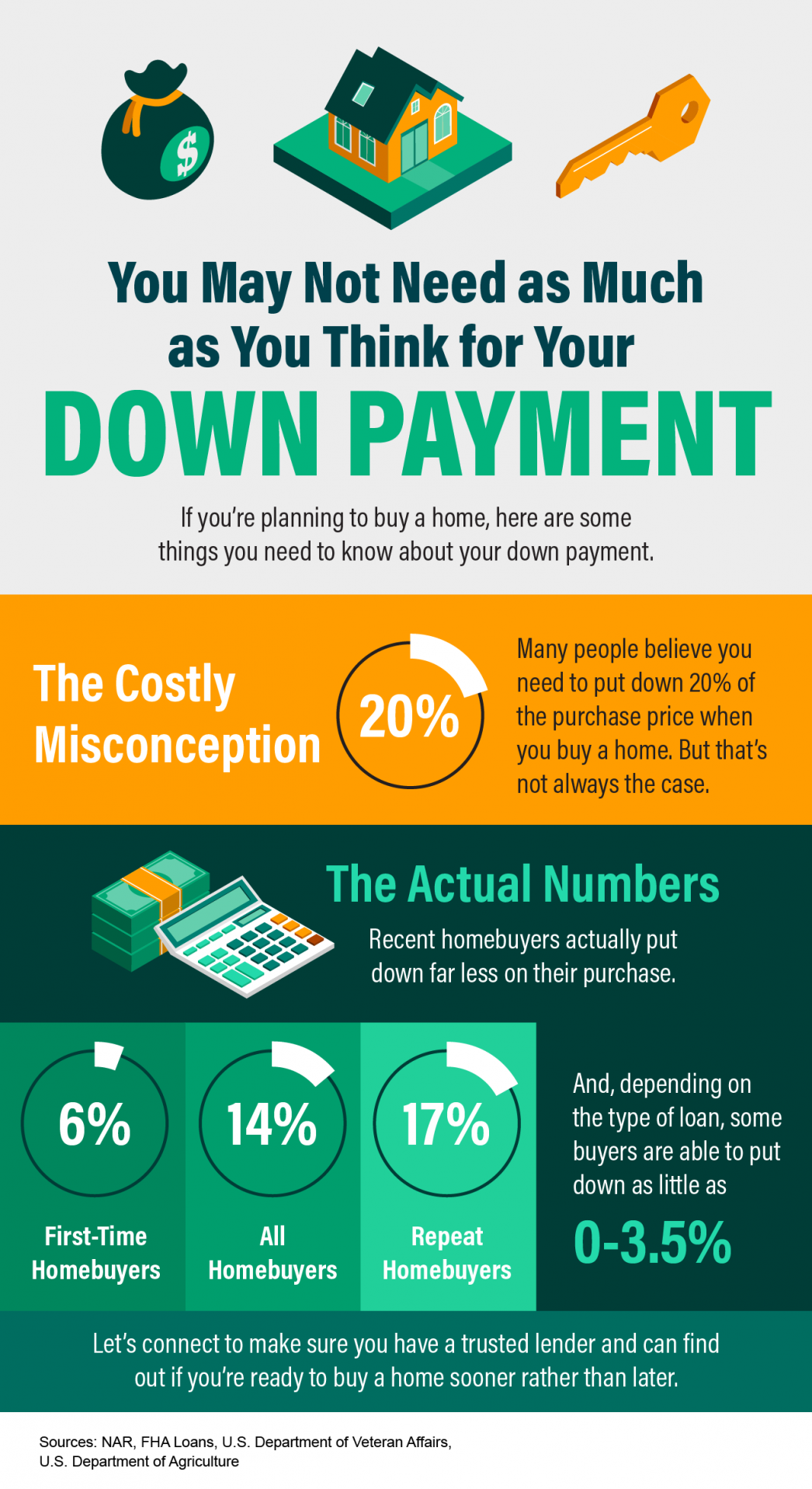

How Much Down Payment?

You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC] Some Highlights Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase. And with programs like FHA loans, VA loans, and US

Read More

Dreaming of Home Ownership?

What You Want To Know If You’re Pursuing Your Dream of Homeownership If you’re a young adult, you may be thinking about your goals and priorities for the months and years ahead. And if homeownership ranks high on your goal sheet, you’re in good company. Many of your peers are also pursuing their

Read More